south dakota vehicle sales tax exemption

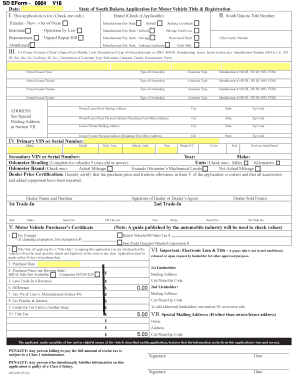

Our online services allow you to. Vehicle Identification Number VIN To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must.

States With No Income Tax Explained Dakotapost

Different areas have varying additional sales taxes as well.

. But that is not all as there are other payments you have to make as well. First multiply the price of the car by 4. All car sales in South Dakota are subject to the 4 statewide sales tax.

Mobile Manufactured homes are subject to the 4 initial. Are NOT exempt from South Dakota sales or use tax. South Dakota Vehicle Sales Tax Exemption.

Laws 44-18-30 Gross Receipts Exempt from Sales and Use Taxes South Carolina SC. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Employee Purchases - The exemption from sales and use tax for the above agencies does not extend to the purchase of products or. To apply the certificate. Municipalities may impose a general municipal sales tax rate of up to 2.

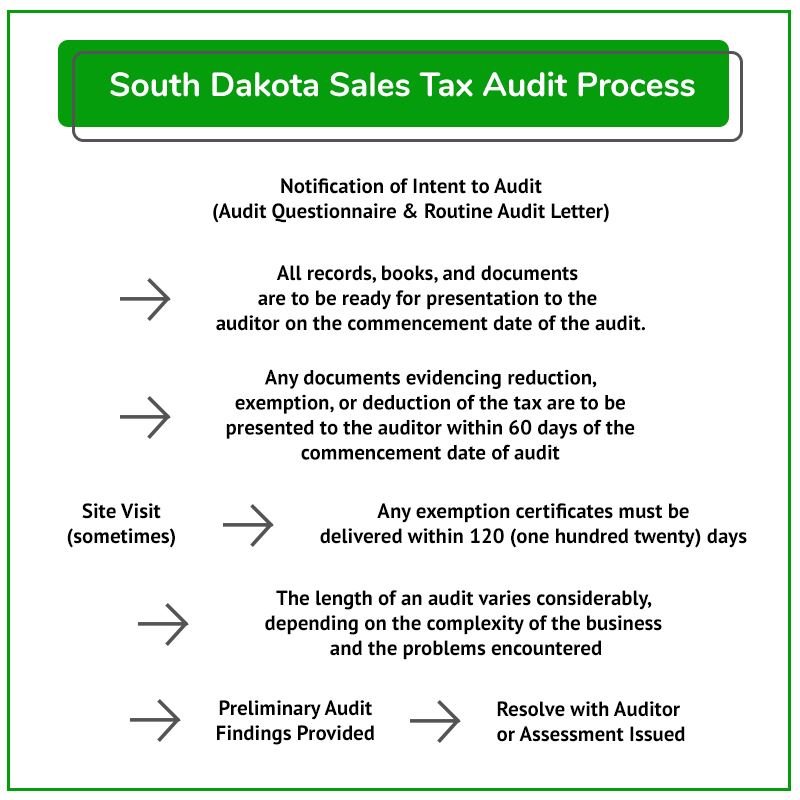

South Dakotas sales and use tax rate is 45 percent. The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes. State of South Dakota and public or municipal.

In addition to taxes car. The Motor Vehicle Division provides and maintains your motor vehicle records. South Dakota Vehicle Excise Tax Explained.

To calculate the sales tax on a car in South Dakota use this easy formula. 12-36-2120 Exemptions from sales tax South Carolina Revenue Ruling. In the state of south dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

For vehicles that are being rented or leased see see taxation of leases and rentals. Owning a car can be rather expensive from the point of buying it. That is the amount you will need to pay in sales tax on your.

This form can be downloaded on this page. SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

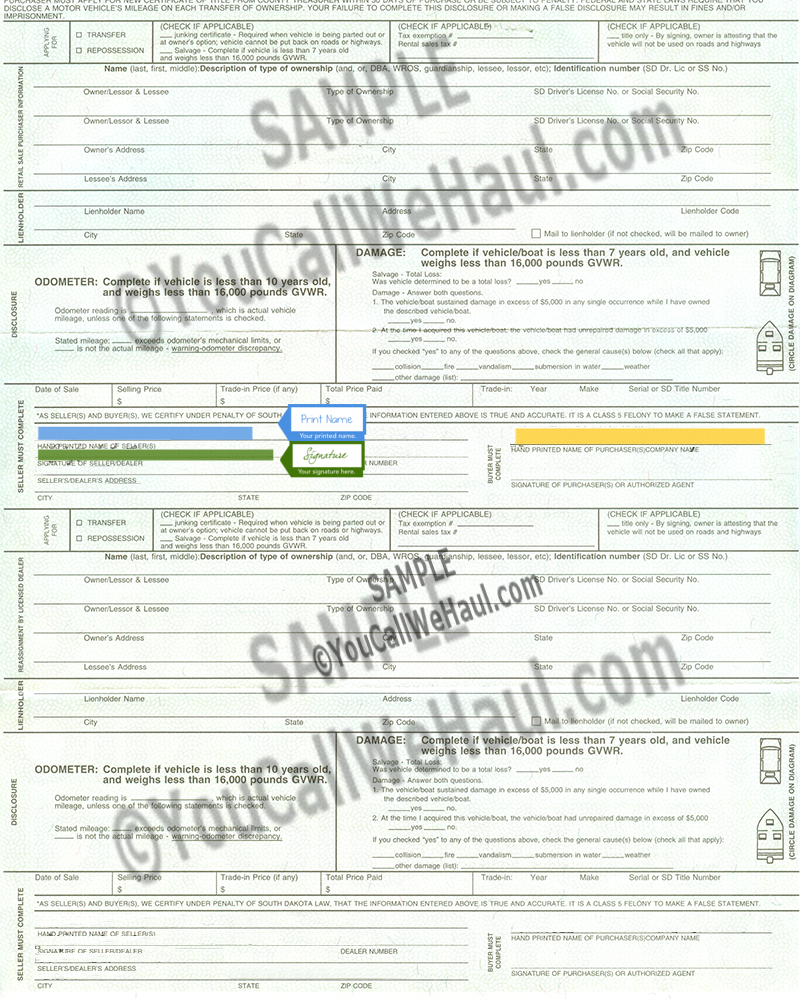

The South Dakota Department of Revenue administers these taxes. The highest sales tax is in Roslyn with a. South Dakota Title Number _____ Odometer Reading is_____which is.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Several examples of items that exempt from South Dakota sales tax are. The South Dakota Streamlined Tax Agreement Certificate of Exemption is utilized for all exempted transactions.

Review and renew your vehicle registrationdecals and license plates. They may also impose a 1 municipal gross. This form is to be used when claiming an exemption from the South Dakota excise tax on a South Dakota titled vehicleboat.

The vehicle is exempt from motor vehicle excise tax under.

Are There Any States With No Property Tax In 2022 Free Investor Guide

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Claim For Sales And Use Tax Exemption Title Registration Motor Vehicle Trailer Atv Vessel Boat Snowmobile

Sales Tax Laws By State Ultimate Guide For Business Owners

Exemptions From The North Dakota Sales Tax

Sales Tax Exemption Forms By State Ssw Dealer Supply

South Dakota Title Application Fill Out And Sign Printable Pdf Template Signnow

Motor Vehicles Sales Amp Repair State Of South Dakota

Meet The District 9 Republicans Candidates Vying For Sd House Senate

South Dakota Sales Tax Guide For Businesses

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Sales Tax On Cars And Vehicles In South Dakota

How To Transfer South Dakota Title And Instructions For Filling Out Your Title

How To Start A Business In South Dakota A How To Start An Llc Small Business Guide

Sales Taxes In The United States Wikipedia

Can I Register A Car In Another State